Indonesia Corona Virus Update #28 September 8, 2020

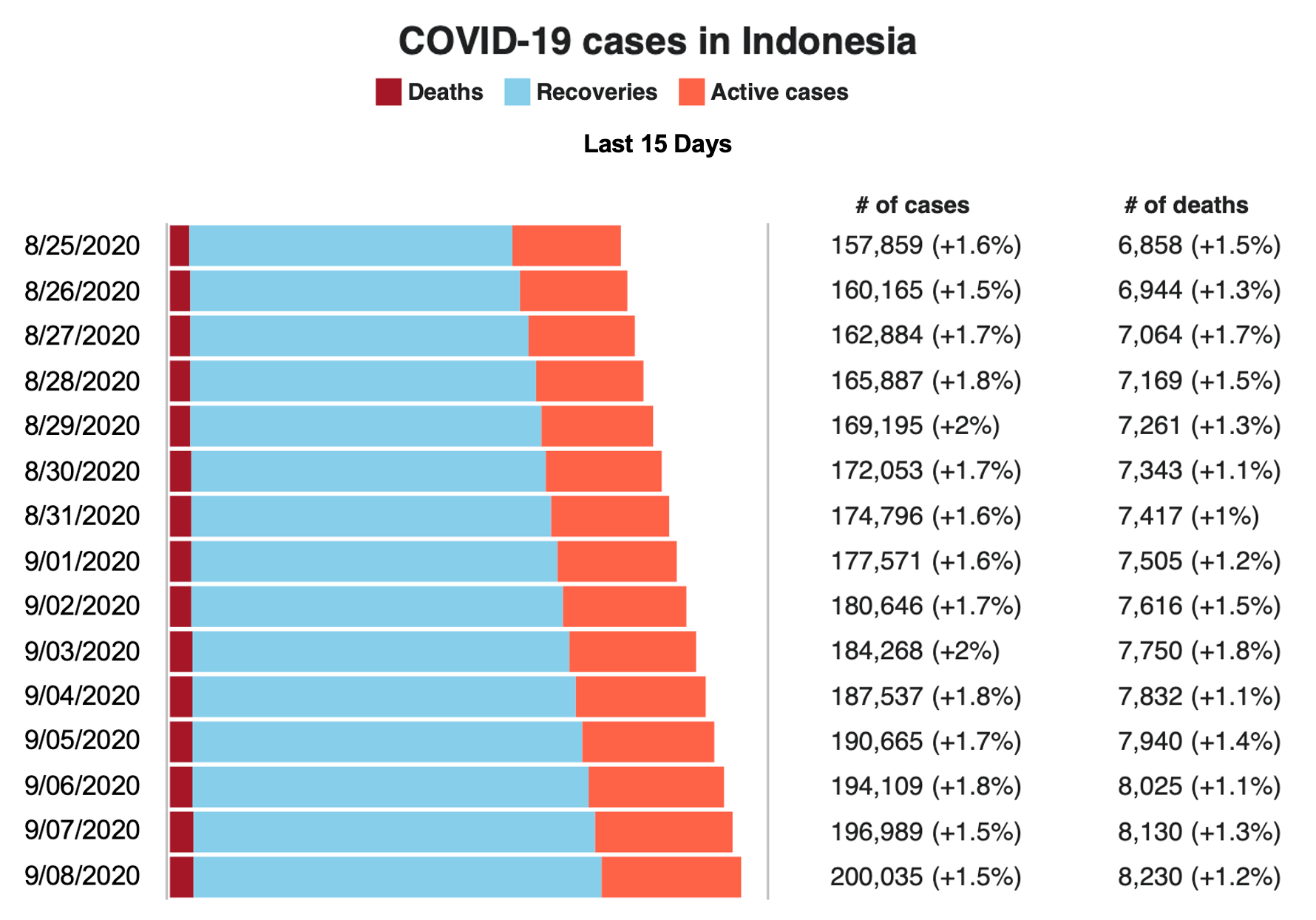

Cumulative number of reported cases: 200,035 (as of September 8)

8230 Deaths

142,958 Recoveries

Rupiah to US$14,795

Jakarta Stock Exchange Index: 5,244

Overview-Cases Increase Above 200,000 and Could Reach 500,000

As Indonesia crossed the 200,000 case mark, Reuters reported that a milder but more infectious mutation of COVID-19 has been found in Indonesia and researchers are trying to determine if that is behind the recent rise in case numbers. The strain, which the World Health Organization said was identified in February and has been circulating in Europe and the Americas, has also been found in neighboring Singapore and Malaysia.

In the week ending September 4 total case growth in Jakarta surged to 17%; active cases also grew as did fatalities. Governor Anies Baswedan and President Jokowi are considering returning to a stricter policy for Jakarta to control the outbreak. They haven’t specified it yet but it could include some type of temporary lockdown.

Syahrizal Syarif, an epidemiologist with the University of Indonesia, warned Indonesians must remain vigilant, as his modelling suggests the country may see its caseload rise to 500,000 by the end of the year. “The situation is serious …. Local transmission currently is out of control,” Syarif said, adding that the number of infections found daily could have been much higher if laboratories were able to process more specimens in a day.

Travel-More Restrictions

Malaysia announced a temporary ban on all travelers from Indonesia, Philippines, India, the United States, the United Kingdom, Brazil, Russia, Spain, Bangladesh, France, Saudi Arabia and Italy, all of which are among the top 25 countries with the most confirmed COVID-19 cases. At least 59 countries have restricted entry of Indonesian citizens over concerns of the high number of Covid-19 positive cases in the country. Meanwhile, national flag carrier Garuda Indonesia has resumed flight services to 2 cities in China following months of travel restrictions due to the coronavirus pandemic. Currently only essential business and diplomatic travel is allowed.

Economic

- Financial Sector Reform: Indonesia’s Parliament is about to begin deliberating revisions to the legislation that created the Financial Sector Authority (OJK) and Bank Indonesia (BI) as independent entities. The proposals would:

- Broaden BI’s mandate beyond inflation to cover growth and jobs

- Move OJK’s bank supervision role back under BI, where it was before 2011

- Impose a monetary board above BI chaired by the Finance Minister

- Mandate BI’s future policy tool of debt monetization (buying government bonds at zero or low interest) if needed to address systemic risk and avoid a financial crisis

Indonesia’s legislative rules require that the government explicitly approve legislation before it can be deliberated and that hasn’t yet happened. The perception of increased financial risks may have led to a slippage in Indonesia’s currency, stirring responses from ratings agencies, government securities firms and regional economists. Some pointed out that giving BI a mandate to include jobs and growth was similar to that of the US Federal Reserve, others suggested the plan gave too much monetary authority back to the Finance Ministry where it had been prior to 1998 and could lead to future imprudent decisions.

In response to the concerns Finance Minister Sri Mulyani reiterated on September 4 that BI’s independence will be maintained, echoing similar comments made by President Joko Widodo. However, irrespective of these comments it appears that some key changes will be put forward to achieve better government control over the banking system.

- Inflation: According to the National Statistics Agency (BPS), Indonesia recorded the lowest inflation in two decades in August as consumer prices fell due to weakening purchasing power. Indonesia’s consumer price index (CPI) declined to 1.32 percent in August.

- Forex at a High: Indonesia’s foreign exchange (forex) reserves soared to a record high in August mainly due to the government’s foreign borrowing, proceeds from oil and gas, as well as tax collection, Bank Indonesia announced. The nation’s forex reserves rose by US$1.9 billion to $137 billion, surpassing the previous record of $135.1 billion a month earlier.

- Manufacturing Activity Rises: Based on IHS Markit’s Manufacturing Purchasing Managers’ Index (PMI) for Indonesia (a gauge of the country’s manufacturing activity) Indonesia’s manufacturing activity has shown signs of improvement for the first time since February, but risks remain as new COVID-19 clusters emerge in factories and industrial areas and as household spending remains weak. Similarly, observers are noticing more trucks traveling on Jakarta’s toll roads.

(sources: International and Indonesia news media, Bali Update (from balidiscovery.com), Reformasi Weekly)