Coronavirus Update #47 January 18, 2021

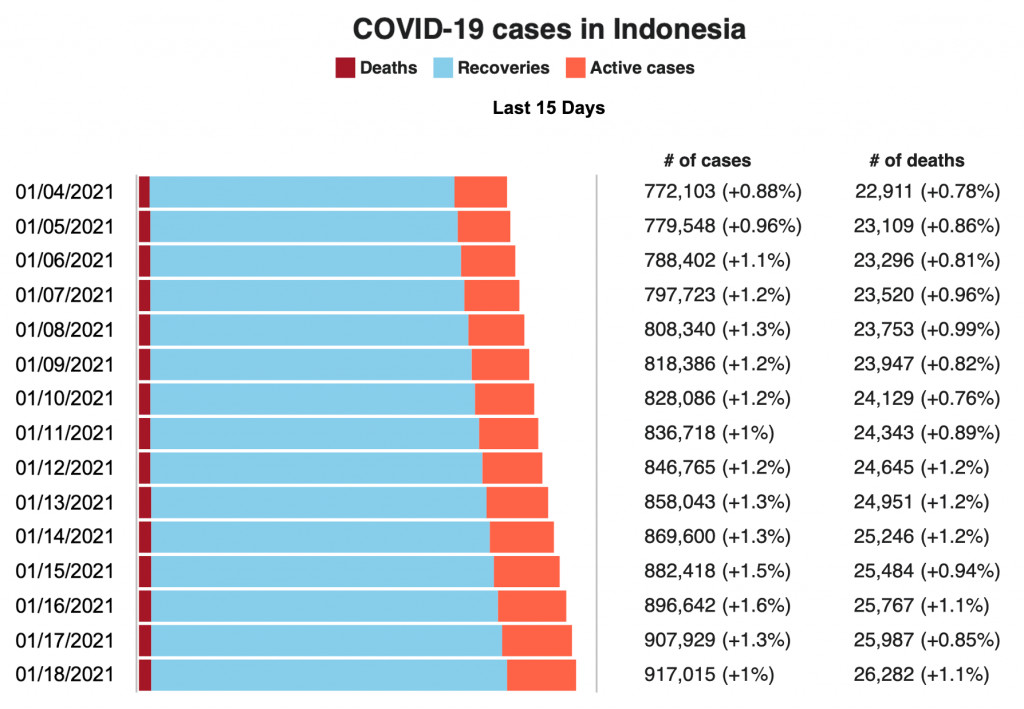

Cumulative number of reported cases: 917,015 (as of January 18)

Recovered: 745,935

Deaths: 26,282

Rupiah to US$14,090

Jakarta Stock Exchange Index: 6389

Overview-

President Jokowi and many other “influencers” received their initial COVID vaccine injections on January 12, symbolizing the government’s concern for public confidence in the Chinese-made product “Coronovac”. Frontline workers are already receiving the vaccine.

Hospitals in Jakarta are overflowing with COVID patients. CNN Indonesia reported the case of a patient who died in a taxi after being turned away by 10 hospitals.

Although testing in Indonesia and Brazil revealed efficacy rates of 50-65% it still can have an impact. The vaccine’s effectiveness at preventing loss of life is closer to 100% and 75% for preventing mild, flu-like symptoms.

Severe flooding in South Kalimantan has displaced over 20,000 people, complicating COVID testing and the vaccine rollout.

Travel-

Foreign travel restriction to Indonesia is currently active until January 28 while the Covid-19 restrictions (PKPM) for most of Java and Bali is in effect at least through January 25 – depending on the Covid-19 case numbers.

Economic-

- Trade Surplus: Indonesia booked a record trade surplus in 2020 as imports fell steeper than exports due to the COVID-19 pandemic. The country logged a trade surplus of US$21.74 billion last year, the second-highest figure in the country’s history, as imports plunged, a signal that economists said reflected a lagging domestic economic recovery.

- Important Change to Negative Investment List: A draft of revisions to Indonesia’s list of sectors closed for foreign investment, known as the DNI or “Negative Investment List”, circulated last week online at the website of the Coordinating Ministry for Economic Affairs. These revisions were promised by the government in the wake of last year’s passing of the Omnibus Bill on Job Creation. Since the list was last revised in 2016 several attempts to make into a more transparent and “positive” list (even by BKPM itself) have dissipated. However, given the severe economic and health crisis, this year may be the year. If what is in the draft remains, the revisions would open many more sectors to foreign investment but vested interests could still derail or alter it.

- EU Metals Action: The EU is planning to request the establishment of a panel to rule on the legality of Indonesia’s export restrictions at the next meeting of the World Trade Organization’s (WTO) Dispute Settlement Body (DBS) on Jan. 25. Indonesian Trade Minister Muhammad Lutfi said on Jan. 15 that the country would participate in the dispute settlement process while the EU sought to prove its allegations. The world’s largest nickel ore producer, Indonesia has banned the export of the ore since January 2020 through an Energy and Mineral Resources Ministerial regulation issued in November 2019. The EU believes the export restriction has contributed to Indonesia’s rise as the world’s second-largest producer of stainless steel, of which raw nickel is a key ingredient, “fueled by unfair and illegal advantages”, according to a Jan. 14 European Commission press release. (AICC has advised against export bans and has pointed to the case of rubber as a natural resource that is still exported in raw or semi-processed form as well as a manufactured product. Furthermore, previous export bans in rattan and forest timber did not lead to sufficient local manufacturing to absorb the available supply of raw material.)