American Indonesian Chamber of Commerce

- HOME

- ABOUT AICC

- The History of AICC

- Major Initiatives

- Trade, Tourism, and Investment Program (TTI)

- Opportunity Indonesia

- Introducing Indonesia: Scholastic Ambassador Program

- Preventing A Lost Generation

- Comprehensive Indonesian-English Dictionary

- Sustain Sumatra

- 10 Year’s After: A nationwide public awareness program

- Support to Mandiri Craft

- Congressional Staff Visit

- Business and Cultural Programs in Dallas, Texas

- US-Indonesia Women’s CEO Summit

- Topeng Sehat: AICC Initiative Against COVID-19

- 2021 Shipping NYC Surplus PPE To Indonesia

- Board of Directors

- Membership Benefits

- FAQ

- Membership Registration and Forms

- EVENTS

- LINKS

- TRADE LEADS

- LATEST NEWS/COMMENTARY

- DOING BUSINESSS

- COUNTRY DATA

- BLOG POSTS

AMERICAN INDONESIAN CHAMBER OF COMMERCE

Search Our Site

Your Trusted Partner

Since 1949, AICC has been your trusted partner in pursuing quality bilateral business objectives. Whether you are a US firm, Indonesian company, or individual researching the Indonesian market, AICC and its network of members in both countries stand ready to help make your enterprise a success.

Discover the power of our superior services

Discover our superior services

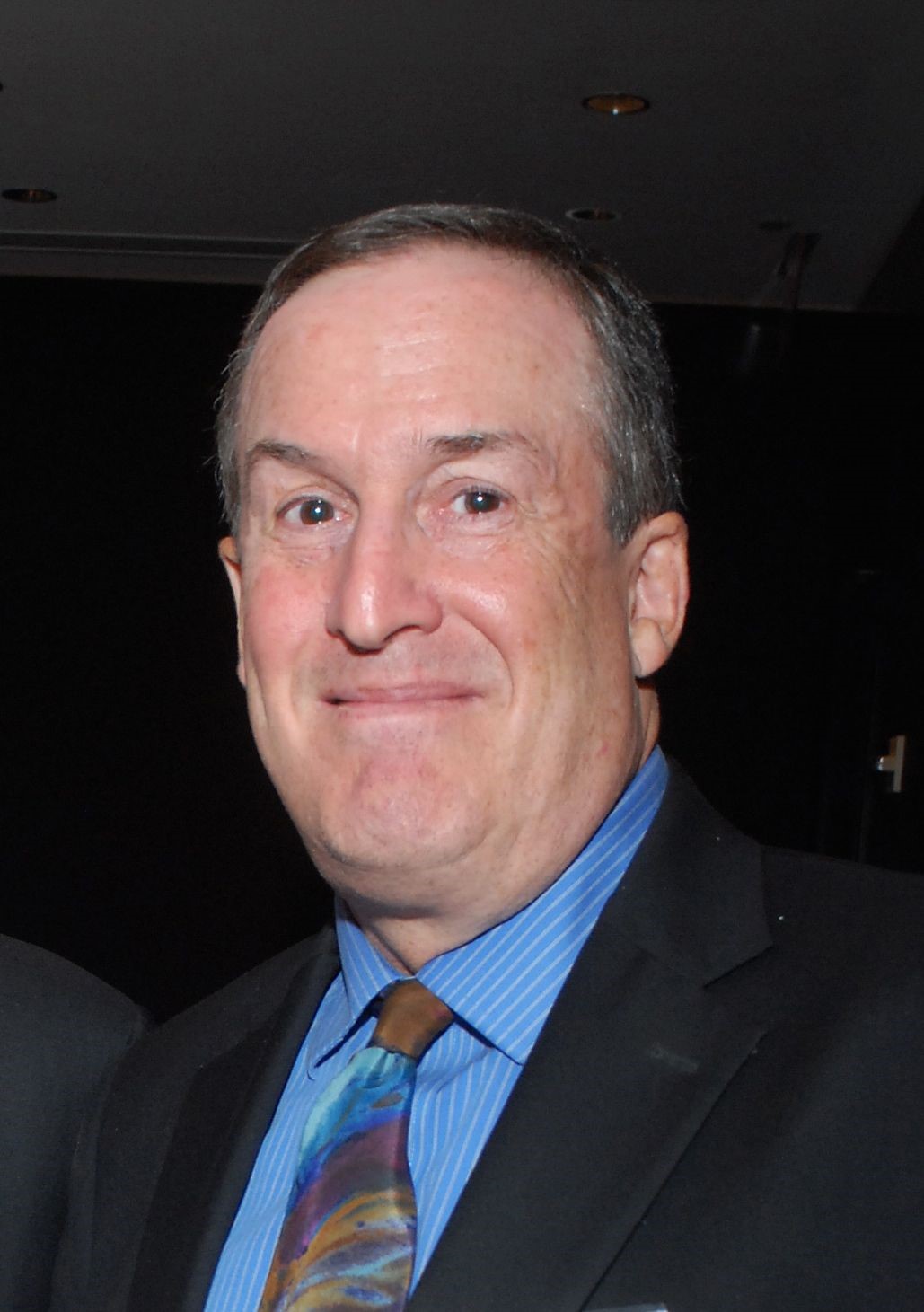

Wayne Forrest

President

Chambers of Commerce provide valuable resources, discounts, and relationships that help businesses save money and market their products. Joining a chamber of commerce can boost sales and improve a local business’ visibility and credibility.

Supported by Companies that trust our services

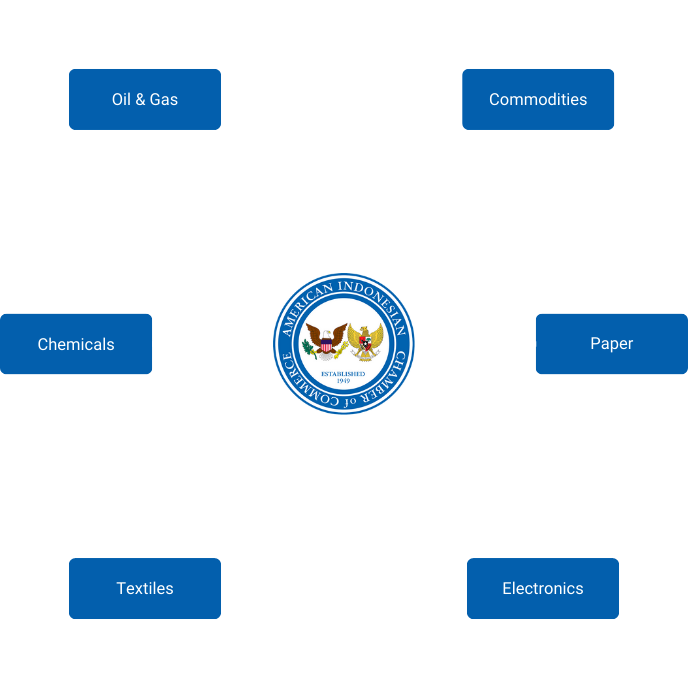

Your partner in international growth

Helping you expand your business across Indonesia.

Indonesia has a stable political system and a reform-oriented government that supports economic development and innovation.

Indonesia has a rich and vibrant culture, with friendly and hospitable people who are open to new ideas and opportunities.

Indonesia has abundant natural resources and a strategic location in Southeast Asia, making it an attractive destination for trade and tourism.

Bridging cultures and strategies

Improves communication and collaboration by reducing barriers and conflicts.

Indonesia offers various incentives for foreign investors, such as tax breaks, simplified licensing procedures, and special economic zones.

Indonesia has a large and growing market with over 270 million people and a rising middle class.

Indonesia has a young and dynamic workforce with a high literacy rate and a diverse cultural background.

Take a look at our articles & resources

Take a look at our articles & resources

This Week’s Major News Stories

This Week’s News in Indonesia.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.