Overview-New Cases Declining/Vaccines Arriving

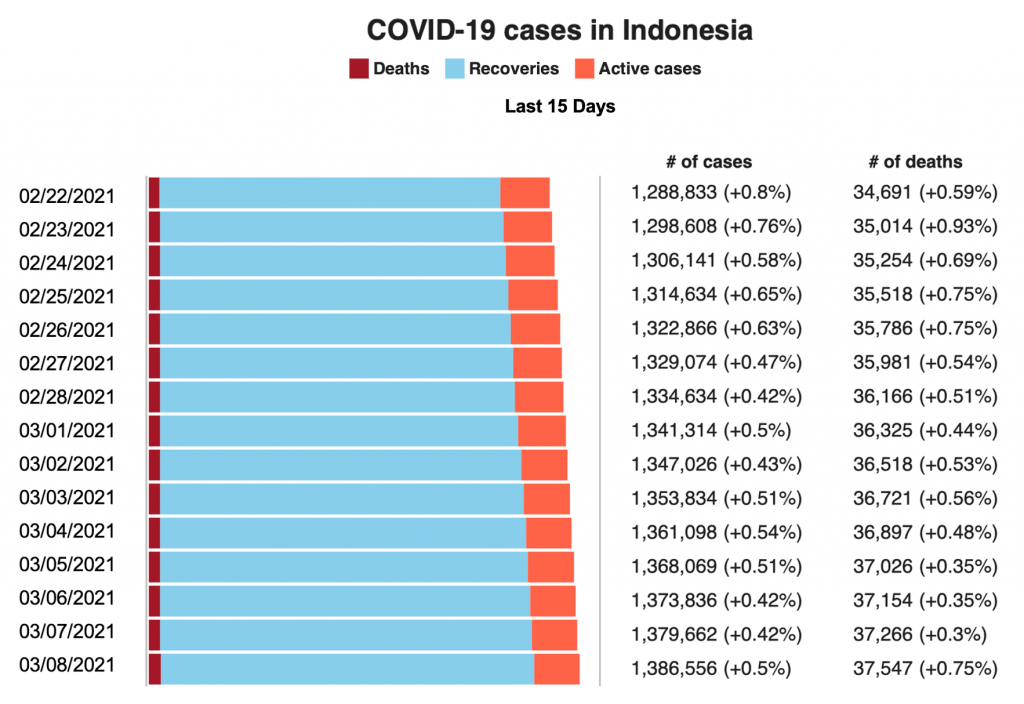

New daily case detection have dropped 25% week-on-week since a February 1 peak. Officials announced that the UK variant of CornonaVirus-19 had been identified in two travelers arriving in Jakarta from Saudi Arabia. The two were returning Indonesian migrant workers.

Through March 4, 2.3 million recipients have received a first vaccination, and 1.1 million have received both. 10 million Sinovac doses just arrived from China as well as 1.1 million of the AstraZeneca COVID-19 vaccine through the COVAX facility.

The private sector vaccine initiative (known locally as the Gotong Royong program) has now been formalized by a Health Ministry decree. It will buy a different vaccine brand than that of the national program (subject to an emergency use authorization) and requires recipients (recruited through the local chamber of commerce, KADIN) to be registered in a national database. PT BioFarma will distribute the Gotong Royong vaccines to verified private clinics with prices set by the Health Ministry. Essentially, private organizations (companies, NGO’s) can buy vaccines for their workers, who receive them at no cost. The addition of another distribution and tracking system could cause more confusion and inefficiency, some analysts indicate.

Travel- Restrictions Remain In Place

Restrictions on non-Indonesian travel remain in place. You currently can enter, subject to airline availability, if you have a sponsor. Business but not personal travel is allowed. Websites at Indonesian consulates and embassies maintain and update the procedures and stipulations. The New York consulate: https://kemlu.go.id/newyork/en/pages/notice_to_visa_applicants_re_covid-19/3471/etc-menu

Economic-

- Tax Decree: The Finance Minister issues a lengthy decree implementing tax policy resulting from the Omnibus Law on Job Creation (October 2020). The decree redefines the basis for taxing non-Indonesian taxpayers: instead of worldwide income, only income derived in Indonesia will be taxed. Treaties on avoidance of double taxation (such as the one between the US and Indonesia) can be used if the taxpayer chooses. The exemption, however, is only for 4 years and the decree is limited to 25 specifically defined jobs. Expats receiving the exemption must also transfer skills to an Indonesian. The decree changes the policy towards dividends: they may now be tax exempt if 30% are reinvested locally. Of importance to exporters, the decree clarifies procedures for submitting tax invoices for value-added tax (VAT) to process refunds as well as the calculation of interest due on payments made on assessments that later prove excessive.

- Rupiah down- Higher yielding US Treasuries as well as the anticipation of measures to blunt perception of a rise in inflation have pushed the rupiah lower.

- IMF Economic Projections: According to the latest IMF Country Assessment, the Indonesian economy is gradually recovering, owing in part to a bold, comprehensive, and coordinated policy response to address the socio-economic hardship inflicted by the COVID 19 pandemic in the first half of 2020. The country’s GDP is projected to expand by 4.8% in 2021 and 6% in 2022. Meanwhile, inflation is set to rise gradually to 3%(y/y) at the end of 2021. The current account deficit is expected to widen to 1.5% of GDP in 2021, reflecting higher imports driven by economic recovery. The IMF noted that Indonesia’s strong fundamentals and prudent macroeconomic policy track record have contributed to its economic resilience.

- SPACS and IDE: The Indonesian stock exchange (DX) will modify its rules to attract local tech unicorns to list. The move is a response to a new worldwide practice of using a special purpose acquisition company (SPAC)—in many cases a shell company—to go public with the intention to buy another company. The idea is that because the listed company has few operations, the due diligence for the listing will have a shorter time frame. In announcing its decision, the IDX indicated it would modify its policies to allow loss-making tech startups to list. Indonesian tech companies Traveloka, Bukalapak and Tokopedia are reported to be considering listing abroad.

|